Our Sustainability Approach

We believe in building a resilient and sustainable business while doing good. We embed sustainability into our business strategy, forge strong relationships and create sustainable value, all of which positively impact our stakeholders.

Sustainability Highlights

S$1.3 billion

of total green and sustainable

financing

3

sustainable initiatives

implemented for the

benefit of tenants

56%

of portfolio (by GFA)

is green certified

51%

of portfolio (by NLA) is covered by green leases

Supplier Code of Conduct

implemented in Singapore

High rating of 3.8 and 4.1

for the Manager’s ESG efforts and property management services respectively, in 2024 tenant satisfaction survey1

1 Tenants rate their satisfaction level based on a scale of 1 (Very Poor) to 5 (Very Good).

As at 31st March 2025

4.3%

reduction in portfolio

energy intensity1 from FY23/24 baseline

71.1 MWp

of total solar generating

capacity, the largest

among S-REITs reported

to-date

Neutralised Scope 2 emissions

in China and Hong Kong SAR

as a combined market

>1,700 trees

planted across MLT’s

assets in FY24/25

1 Based on the consumption data for the common areas in MLT’s stabilised multi-tenanted buildings (“MTBs”) where the Manager has operational control. Single-user assets (“SUAs”) where the Manager does not have operational control are excluded.

As at 31st March 2025

48

average training hours per employee

48%

of management positions held by women

375

staff volunteer hours across eight markets

Zero

material incidences of non-compliance with health and safety laws and regulations

As at 31st March 2025

Zero

material incidences of non-compliance with relevant laws and regulations

36%

female representation

on the Board

55%

Independent Directors

on the Board

Recognised for

Exemplary Board Diversity

in the 2025 Singapore Board Diversity index

Zero

incidences of non-compliance

with anti-corruption laws

and regulations

3-Star Rating

in the 2024 GRESB

Real Estate Assessment

11.1

Low Risk

Morningstar Sustainalytics ESG Risk Rating

As at 31st March 2025

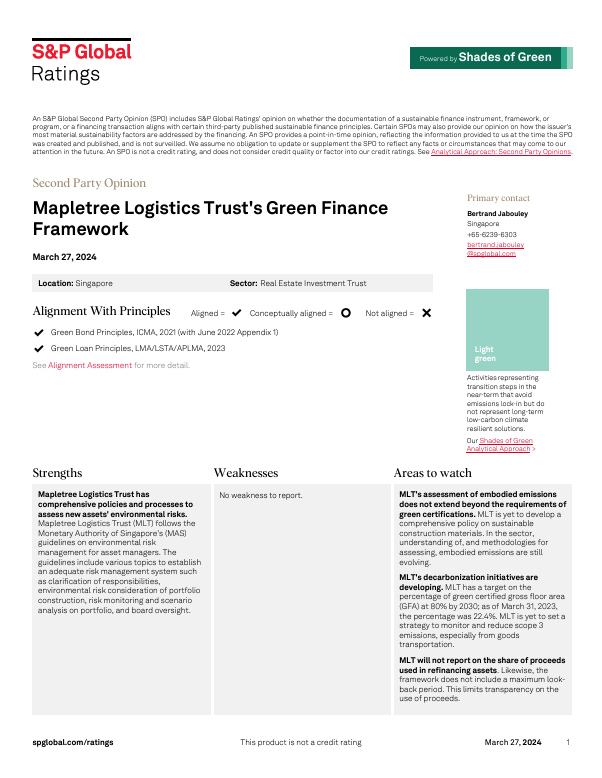

Green Financing

MLT’s Green Finance Framework (the “Framework”) has been developed with the intent to enter into Green Finance Transactions to finance or refinance projects that deliver environmental and social benefits, supporting MLT’s sustainability objectives. The Framework has received a second-party opinion from S&P Global Ratings, confirming its alignment with the Green Bond Principles 2021 and the Green Loan Principles 2023. It guides MLT in allocating proceeds from these transactions to eligible projects in green buildings, renewable energy, energy efficiency, and sustainable water management. Both the Framework and S&P Global Ratings’ second-party opinion are available below.

Green Finance Framework

March 2024

Second Party Opinion Report by S&P Global Ratings

March 2024

Learn More in Our Latest Sustainability Report

Delivering Sustainable Value FY24/25